Market Watch

Mid Year Real Estate Update for Southwest Montana

Posted on July 18, 2025Montana's Housing Market: A Look at Job Growth, Regional Prices, and What's Next

Staying informed about the real estate market is key for homeowners and aspiring buyers alike. While national headlines provide a broad overview, understanding what’s happening closer to home is crucial. Drawing from a recent forecast by the National Association of REALTORS®, we can piece together a picture of the economic forces shaping Montana's housing landscape. 1

Job Growth

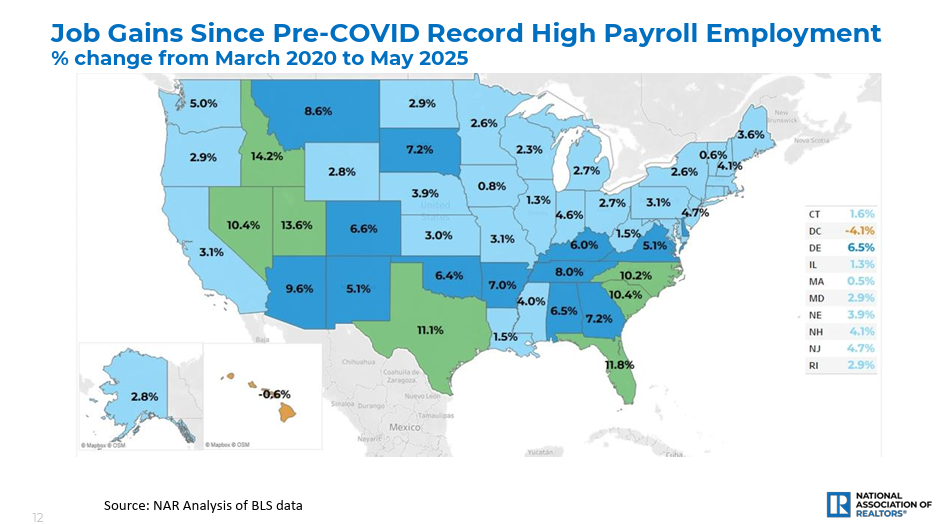

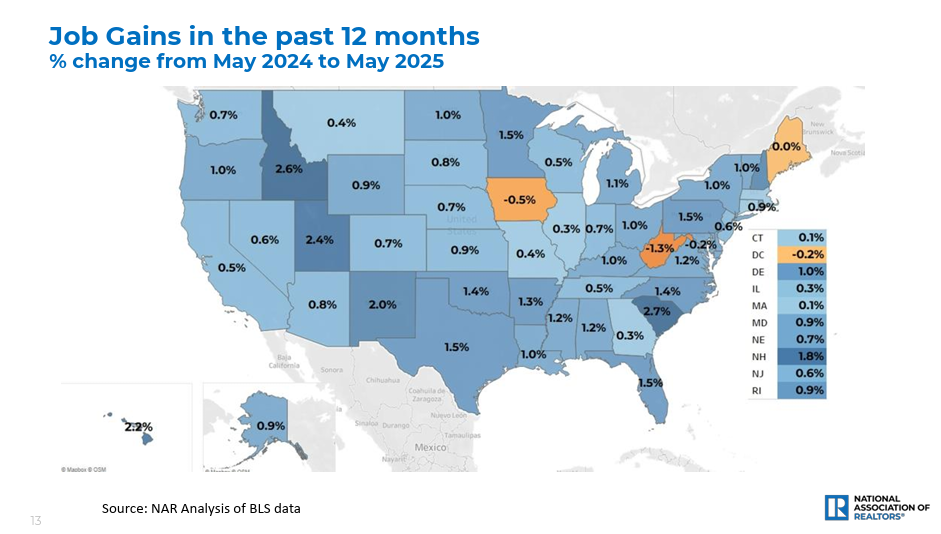

A strong job market is fundamental to a healthy housing market. Montana has seen significant job growth since the beginning of the COVID-19 pandemic.

- From March 2020 to May 2025, payroll employment in Montana increased by 8.6%.

- More recently, the state saw a 0.4% increase in job gains between May 2024 and May 2025.

This steady employment picture provides a stable foundation for the state's economy and housing demand.

Regional Price Perspective

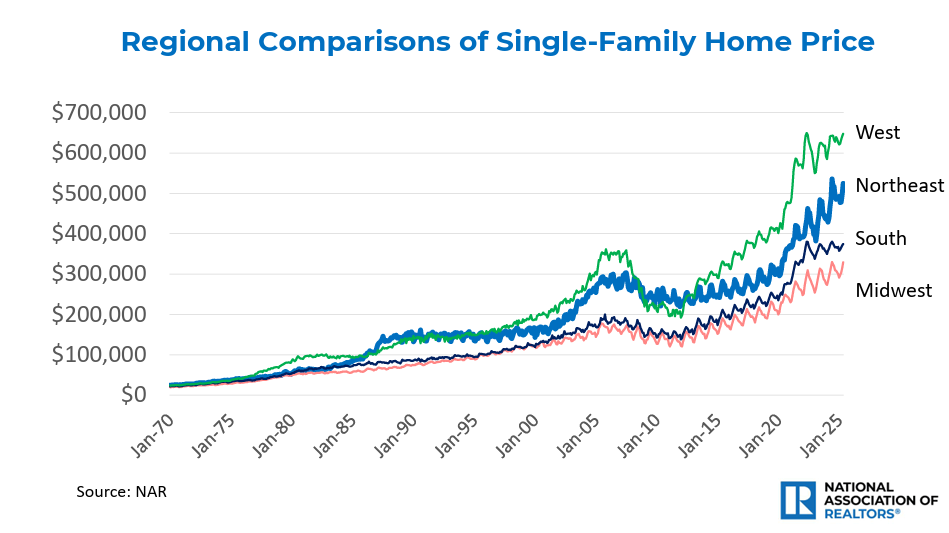

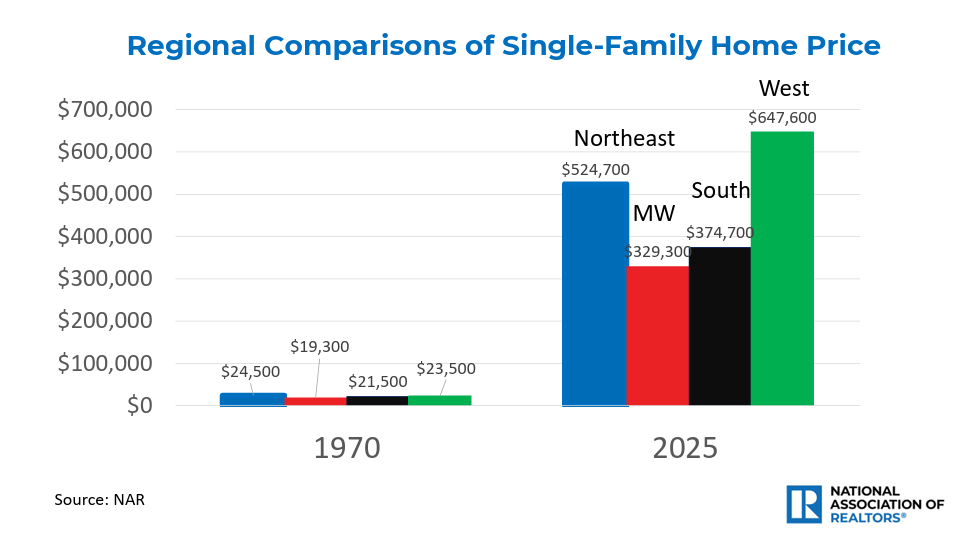

While the report doesn't break down home prices for Montana individually, it does provide a look at the U.S. West, the region Montana is a part of.

- Historically, the West has led the nation in single-family home prices.

- In 2025, the median home price in the West is forecast to be $647,600. This compares to a median price of just $23,500 in 1970.

The National Outlook: Interest Rates and Affordability

Broader economic trends, particularly mortgage rates and inflation, impact buyers and sellers everywhere, including Montana.

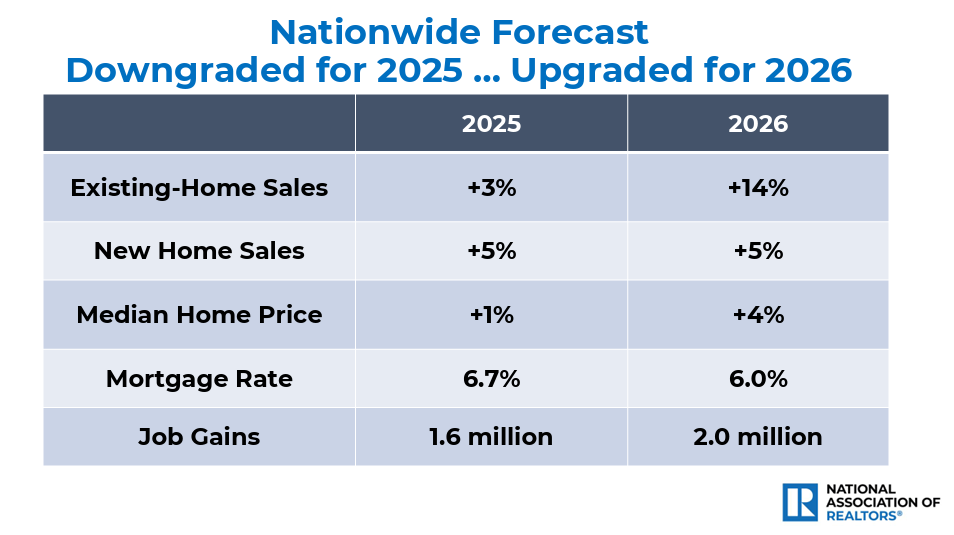

- Mortgage Rates: The average 30-year fixed mortgage rate is forecasted to be 6.7% in 2025, potentially decreasing to 6.0% in 2026.

- Home Sales and Prices: Nationally, existing-home sales are predicted to see a modest 3% rise in 2025, with a more substantial 14% increase in 20268. The median home price is expected to grow by 1% in 2025 and 4% in 2026.

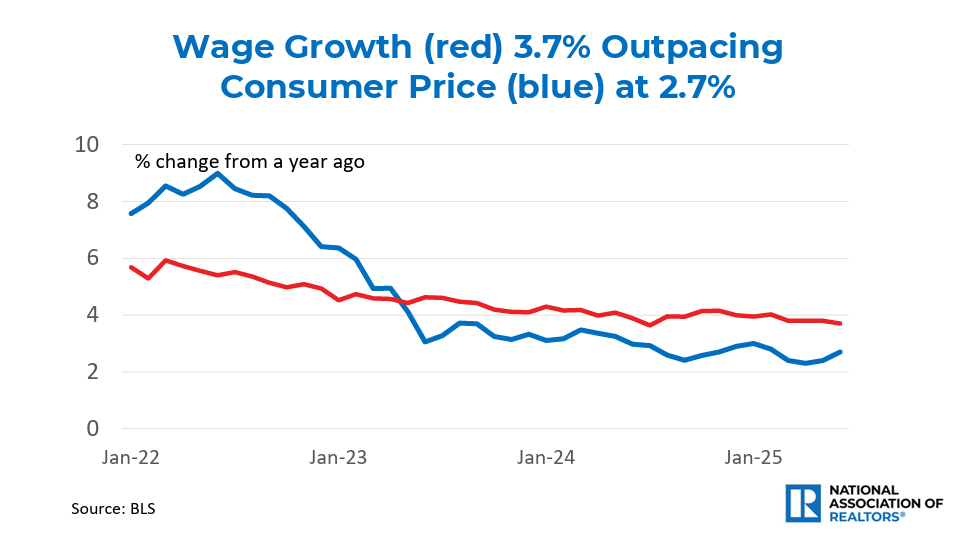

- Income and Inflation: On a positive note, wage growth is currently outpacing inflation. As of the latest data, wages have grown by 3.7% year-over-year, while consumer prices have risen by 2.7%10. This trend helps improve purchasing power for potential homebuyers.

For those considering buying or selling in Montana, these insights suggest a market influenced by steady local job growth, high regional home values, and a national environment that may see borrowing costs ease in the coming year. For the most current and localized information, consulting with a local real estate professional is always the best next step.